How I get “free” Disney World Vacations.

A simple 4 step process to ensuring I never pay out of pocket for a vacation again.

I know for a lot of folks, including us, our Disney trips took place on a 2-3 year cycle. That allowed us enough time to save money and figure out the game plan for the trip. In 2020/2021 I stumbled across an idea that has become the perfect way to never have to pay for a vacation again. Intrigued? Read on!

Walt Disney World - Magic Kingdome, Castle

IS THIS LEGIT?

Hold on, this is not going to be a post about using Timeshares or anything of that nature.

This is a legitimate method I am using IN THE REAL WORLD to pay for our Oct 2024 Disney World vacation.

Moving forward, I intend to use it for ALL my family vacations.

NOTHING IN THIS POST IS TO BE CONSTRUED AS FINANCIAL, TAX, OR LEGAL ADVICE.

I’M MERELY SHARING MY PERSONAL STRAGETY FOR MY FINANCES AS A FRAME OF REFERENCE.

INVESTING INVOLVES HIGH RISK AND POTENTIAL LOSS OF MONEY.

I AM NOT A FINANCIAL ADVISOR.

Let’s cut to the chase, obviously everything has a cost and nothing is truly free. But this is something I wanted to try, and some 3 years into this overall experiment it is working.

Walt Disney World - Lion King Show

Step 1 - PUT IN THE WORK

For those who don’t know my back story - in 2020/2021 during the Covid Pandemic, some friends and I started talking about trying to use investment income to supplement our day job income. But, I didn’t have any spare cash and needed money to start investing. Enter -The Side Hustle. Plus, I didn’t want to use my day job money that I used to pay my bills. I wanted money that didn’t matter if I lost it all in the market.

My girlfriend was already doing food delivery as a side hustle. So that gave me a starting point. I started working a variety of side gigs in addition to my 9-5 since we all had a lot more free time because there was no commuting to work and a lot of stuff was shut down. Here’s the things I did from Fall 2020 until the summer of 2023:

Food Delivery (Door Dash/Uber Eats)

Online Survey Taking

Affiliate Marketing through Amazon and Collective Voice

On top of that I also began to add the following in 2023:

Credit Card reward cash (mine pays 3%-5% cash back on most everything.)

Cash back from the “Upside” App

Tax refunds

9-5 bonus pay

9-5 overtime

Walt Disney World - Water fountains, Epcot

Step 2 - START INVESTING

I took all that cash on the side and started buying high yield dividend stocks and ETFs with it. This nice thing about Food Delivery was, that paid out at the first of every week. So every Monday and Tuesday I was able to go on a buying spree. Over those 3 years or so, I experimented with A LOT of stocks and ETFs before settling on my current portfolio. As you can see below, the three funds highlighted in green are what I’m using to pay for all my vacations. It’s a small percentage of my overall portfolio. Other funds in there can be used to pay for other things like:

Eating out

House cleaning services

Car wash subscription

Netflix/YouTube TV etc.

Gym membership

As a result, none of those expenses actually take money out of my checking account and can be funded by investments!

There are a lot of YouTube videos on “high yield dividend” investing, and that’s where I got my start on this topic. Because before 2021, I didn’t know anything about it. Everything online, I take with a grain of salt. But now 3 years into it, I’m becoming a believer in this method of investing for monthly cash flow and passive income.

There are some tax implications, but I have adjusted my W4 to have more taxes taken out every paycheck to offset taxes from the income generated from my dividends and distributions.

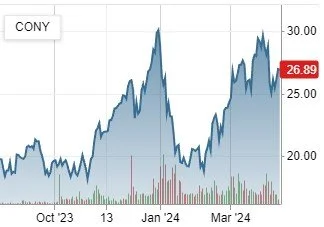

What I decided to do for the vacation portfolio is take a very aggressive high risk approach with 3 YieldMax ETFs. Current balances are:

AMDY - $2,788, 150 SHARES

CONY - $3,885, 155 SHARES

NVDY - $5,262, 200 SHARES

Walt Disney World - Epcot, Space Mountain

SO HOW DOES THIS HELP ME?

You may be wondering what this does for me.

It all depends if you truly understand the philosophy of buying assets and letting those pay for your lifestyle. I hate it that it took me until my mid 40’s to truly get this concept. Since I was 23, I had only been focused on saving for retirement and piling up cash in my 401K and Roth IRA for growth (which is a good plan for sure) But….. Having additional money set aside in a taxable account that pays distributions out monthly will allow me to buy whatever I want, and yet, still have a huge bucket of cash that works for me 24/7/365 without me having to do anything else. It’s like having a big emergency fund that generates you free money every month.

Those 3 years of hard work have brought me some financial freedom. 3 years of sacrifice can change your life.

The main idea back during COVID was, “IF I lose my job, how will I pay my bills?”

I’ve found using this investing method works for me to never have to worry about where money will come from ever again.

Can you imagine if someone starts this at age 22, just out of college with no real financial obligations… At 32 - potentially financially free to do whatever you want whenever you want. That’s the American Dream right there!

(But I’d also say never stop investing in your 401K for the match and also your Roth IRA for tax free money later when you’re 60 something.)

Walt Disney World - Coronado Springs Resort

Step 3 - ENJOY THE REWARDS

APRIL 2024 - Payout #1 ($1,121.74)

As noted above, this is what I put my money in for the vacation fund.

AMDY - $2,788, 150 SHARES

CONY - $3,885, 155 SHARES

NVDY - $5,262, 200 SHARES

So far, that $11,935 invested should generate about $12,000/yr income on average for me based on current payout rates.

For April 2024, I received $1,121.74.

Remember, that $11,935 just sits there - producing about $1,000 every month!

It’s like a cash flow miracle.

While the future of these funds is unknown, if this level of payouts can be kept up along with the stock price holding steady more or less, I'll never have to worry about paying for a vacation out of my pocket ever again!

Disney World - Illuminations Fireworks Show at Epcot.

Step 4 - MONITOR

The overall “look'“ or trend of the charts for the 3 funds I’ve chosen for this vacation portfolio are either “FLAT” or “Slightly upward” which is what I want to see. That means my original principal investment is staying the same, while massive distributions are still being paid out every month. As long as that continues, this strategy will work. Should the chart start showing constant declines, then I’ll look for a different ETF. Since these YieldMax ETFs are very new, no one knows how they’ll perform in a variety of market conditions, but so far, these 3 have done pretty well.

This past week we had a huge drop in the market. That is not really concerning as long as over the next 30-60 days I see the share price of these funds going back up and distributions remain somewhat healthy. The income generated by these funds is really unprecedented in market history.

CONCLUSION

I hope you’ve enjoyed the inside info on how I fund my life and pay for things. It really has become a fundamental mind shift over traditional thinking and what we’re taught in school on money matters.

Traditional

Work —> Pay Bills

Mine

Work —> Buy Assets —> Pay Bills

If you’re intrigued, here’s what you need to do to get started:

I’d recommend getting with your tax advisor/cpa to see what kind of an impact this would have on your taxes before starting out.

Hop on YouTube and start watching videos on “"high yield dividend investing”. There’s a lot of content out there and that may give you some ideas to get started.

Find a side-hustle.

Start investing.

You may be asking, what about your photography income? Why isn’t it listed in the side-hustle category? - In the past I have used it to pay for vacations, as nearly every vacation I end up taking photos to sell or trying new techniques or testing gear out. So all those vacations become business trips and write offs. That may still be the case in some situations, but now I can pour more business money into marketing, buying gear, and education.

One thing to note, I do believe in growth for retirement and definitely keep things simple in my 401K and Roth IRA. Using a basic 3 fund portfolio (VOO, QQQM, SCHD and any variant like that… VTI, QQQ, DGRO, or FXAIX, FDVV, VGT) where you have the S&P 500 index, Nasdaq Index, and a quality dividend ETF will definitely be a winner over the long run too. With current interest rates at 5%, having some cash mixed in there in a money market fund isn’t a bad idea either. But once again, everyone’s life situation and risk tolerance is different. Talk to some professional folks about it before you do anything. Make sure you’re comfortable with investing for sure!

I will provide a monthly update on how this 3-fund vacation portfolio is doing and discuss any updates.

Have a blessed life!

~ Kyle

Kyle Root is a published and award winning photographer based out of Decatur Alabama. Working in the area since 1999 has helped him become one of the most recognized photographers and videographers in North Alabama. His work has been featured both locally and on the national stage.

Get the Hilton Honors American Express Card for Awesome Travel perks!