Follow My Personal Investing Journey!

(I am not a financial advisor, tax lawyer, or accountant. This is not financial or life planning advice.)

In 2020 I discovered the life changing idea of high yield dividend investing. Since then, I’ve gone through a number of stocks, mutual funds, and ETFs trying to find a good mix for my life. Every day I get closer. It’s a never ending journey. I also began trading options as another source of income. Now these things pay for all my vacations and more and act like a giant emergency fund.

It’s important to note that my day job pension and social security will hopefully be paying me around $6,000/mo combined in retirement so I won’t need a ton of money.

Update #4 - How I get “free” Vacations.

Why pay for Disney World, or any vacation, if you don’t have to? In this series, I’ll lay out the exact steps I use that have allowed me to never have to pay for a family vacation out of my own pocket ever again. Anyone with a job and some budgeting can make this happen.

As a reminder, I’m not a financial advisor and this is not investment advice. Do not use money you need to pay bills and feed your family for this kind of experiment.

Refer to my original blog post here for the complete story on how it began.

The “most magical place on earth”, also happens to be a pretty expensive place to visit. I know there are several ways to do it affordably, but for me, I like to splurge a little and enjoy convenience. Especially since I work an average of 50-60 hours a week all the time. So when vacation time rolls around, I want to relax and not have to deal with any hassles.

THE EXPERIMENT

If this is your first time here, what I did was take about $12,000 that I earned from doing side hustles from 2021-2023 (Door Dash, taking surveys, affiliate marketing etc) and invested it into 3 YieldMax ETFs that pay very high monthly distributions. I collect that income and move it to my vacation savings account at my local bank every month. The distribution varies every month, as does the total balance of the amount invested due to stock price movement.

If you’re saying “But you’ve got $12,000, you could easily pay for Disney with that!” - You’re right I could… but doing it this way, in theory - the $12,000 is saved and generates enough income to pay for Disney world (and more) every year for the rest of my life. So if I go 10 more times, instead of “costing $50,000 (10 x $5,000/trip [[2 adults, 3 kids, on-site moderate, 6 days]])” - it only still “cost me” $12,000 - because all the other income was free money generated by my portfolio.

From the math, you’ll realize that $12,000 investment is actually paying me $800-1000/mo - which is $9,600-$12,000 in total income. That is enough to fund all the vacations I take every year. So over the next 20 years, I’m saving almost $240,000 in vacation costs. If this continues to work.

THE UNKNOWN

The Yieldmax funds are relatively new and it’s unknown how they will perform in a down market. There is a subtantial risk of loss of money for sure with these new fund types. That’s why they don’t make up more than about 20% of my portfolio where my play money is, and less than 1% in my retirement account.

As such, I would not recommend anyone go out and do this particular thing unless they are ok with losing their $12,000.

UPDATE #4

As noted previously, I have changed from “Disney vacation fund” to just “Vacation fund”. I began selling options that will also fund “General vacations”. But for this experiment, I’m only going to use income from the 3 funds that I originally began this experiment with.

(I had previously planned on using YMAX as well for general vacations, but this month, we ended up renting an awesome 800 sq ft space for a new photography studio and rent is around $650/mo, so I’m going to use YMAX - since it’s more steady and somewhat reliable - to help make sure rent is covered)

Balance History with current values:

JULY ($13,790)

AMDY - $3,478, 200 SHARES (+ $15)

CONY - $3,848 200 SHARES (- $940)

NVDY - $5,740, 200 SHARES (- $306)

JUNE ($14,297)

AMDY - $3,463, 200 SHARES (+ $147)

CONY - $4,788, 200 SHARES (+ $1429) ** added 45 shares to get to an even 200

NVDY - $6,046, 200 SHARES (+ $962)

MAY ($11,758)

AMDY - $3,316, 200 SHARES (+$528) ** added 50 shares to get to an even 200

CONY - $3,359, 155 SHARES (-$526)

NVDY - $5,084, 200 SHARES (-$178)

APRIL ($11,935)

AMDY - $2,788, 150 SHARES

CONY - $3,885, 155 SHARES

NVDY - $5,262, 200 SHARES

JULY 2024 - PAYOUT #4 ($955.72)

Total Disney World account is now $3,805.43- with 3 months to go.

Averaging the 4 months of payments I’ve received since I began in April to calculate possible future distributions for the next 3 months, we’ll still be right at $6,500 which should be more than enough to pay for everything needed for the 3 (was 4 days - see note at bottom of post) days well actually be on-site at Disney World.

For those who are into visuals, here’s a chart showing the balance and income history to date of this experiment

A NOTE ABOUT JUNE/JULY

We had an unexpected death in the family that took us to Nebraska, which was a 15 hour car ride from home. Since we were going so far into the midwest, we decided to make it into a last minute vacation and we were actually on the road for 8 days total and visited South Dakota and Wyoming on the way out, and then came back through Nebraska and then Illinois then South.

Total Cost for that trip was $1,811.52.

We’ve also got a big beach trip coming up as well that’s going to be around $3,000.

As a result we’ve decided to cut back a day on Disney and instead of 4 days in the parks, we’re going to only do 3 and also leave a day early to save a little bit on the money side.

Your Own Personal Money Printer - The Wheel Strategy

Today, we're diving deep into one of the most popular options trading strategies out there: The Wheel Strategy. If you're looking for a way to generate consistent income from your investments, this might just be what you've been waiting for! I’ve been testing this personally since 2024 and have had pretty solid results. I wish I had known about this 15 years ago! But better late than never.

WHAT IS THE WHEEL STRATEGY?

The Wheel Strategy is a options trading technique that combines cash-secured puts and covered calls to generate income. It's like a merry-go-round of potential profits, hence the name "The Wheel." This strategy is used by many traders for its simplicity and potential for steady returns.

HOW DOES THE WHEEL WORK?

Let's break it down into the three main steps:

Sell cash-secured puts on a stock you wouldn't mind owning.

If the put is assigned, you buy the stock at the strike price.

Once you own the stock, sell covered calls against your shares.

Rinse and repeat! It's that simple.

THE BENEFITS OF THE WHEEL STRATEGY

Consistent Income Generation - One of the biggest perks of The Wheel Strategy is its potential to generate regular income. By selling options, you're collecting premiums whether the stock moves up, down, or sideways.

Lower Risk Than Other Options Strategies - Compared to more complex options strategies, The Wheel is relatively low-risk. You're always either holding cash (for the puts) or owning stock you're comfortable with.

Flexibility - The Wheel Strategy allows you to adjust your approach based on market conditions. You can be more aggressive when volatility is high and more conservative when it's low.

Potential for Capital Appreciation - If the stock you're wheeling increases in value, you benefit from that appreciation while still collecting option premiums.

RISKS OF THE WHEEL STRATEGY

While The Wheel Strategy is generally considered lower-risk, it's not without its pitfalls. Let's look at some potential risks:

Stock Price Decline - If the underlying stock's price drops significantly, you could end up owning shares at a higher price than the current market value.

Opportunity Cost - If the stock price rises quickly, your gains may be limited by the covered calls you've sold.

Assignment Risk- There's always a chance of early assignment on American-style options, which could disrupt your strategy.

Market Risk - Like all investing strategies, The Wheel is subject to overall market risk. A broad market downturn could negatively impact your returns.

GETTING STARTED WITH THE WHEEL STRATEGY

Step 1: Choose Your Stock - Pick a stock you wouldn't mind owning long-term. Look for companies with solid fundamentals and a history of steady growth.

Step 2: Sell Cash-Secured Puts - Start by selling puts at a strike price where you'd be happy to buy the stock. Remember, each contract represents 100 shares, so make sure you have enough cash to cover the potential purchase.

Step 3: If Assigned, Own the Stock - If the stock price drops below your put's strike price at expiration, you'll be assigned the shares. Don't worry - this is part of the strategy!

Step 4: Sell Covered Calls - Now that you own the stock, start selling covered calls above your cost basis. This allows you to generate income while potentially selling your shares at a profit.

Step 5: Repeat - If your shares get called away, start back at step 2. If not, keep selling covered calls until they do.

FINAL THOUGHTS

The Wheel Strategy can be a fantastic way to generate income through options trading. It's relatively simple to understand and implement, and it can provide consistent returns over time. However, like any investment strategy, it's crucial to do your homework, understand the risks, and never invest more than you can afford to lose.

Remember, the key to success with The Wheel Strategy is patience and consistency. It's not a get-rich-quick scheme, but rather a methodical approach to building wealth over time.

So, are you ready to give The Wheel a spin? Happy trading, and may the odds be ever in your favor!

To learn more about this and see real examples, there’s lots of great content on YouTube. 2 of my favorite channels are The Average Joe Investor and Trading with Ashley. Check those out!

Update #3 - How I get “free” Vacations.

Why pay for Disney World, or any vacation, if you don’t have to? In this series, I’ll lay out the exact steps I use that have allowed me to never have to pay for a family vacation out of my own pocket ever again. Anyone with a job and some budgeting can make this happen.

As a reminder, I’m not a financial advisor and this is not investment advice. Do not use money you need to pay bills and feed your family for this kind of experiment.

Refer to my original blog post here for the complete story on how it began.

The “most magical place on earth”, also happens to be a pretty expensive place to visit. I know there are several ways to do it affordably, but for me, I like to splurge a little and enjoy convenience. Especially since I work an average of 50-60 hours a week all the time. So when vacation time rolls around, I want to relax and not have to deal with any hassles.

THE EXPERIMENT

If this is your first time here, what I did was take about $12,000 that I earned from doing side hustles from 2021-2023 (Door Dash, taking surveys, affiliate marketing etc) and invested it into 3 YieldMax ETFs that pay very high monthly distributions. I collect that income and move it to my vacation savings account at my local bank every month. The distribution varies every month, as does the total balance of the amount invested due to stock price movement.

If you’re saying “But you’ve got $12,000, you could easily pay for Disney with that!” - You’re right I could… but doing it this way, in theory - the $12,000 is saved and generates enough income to pay for Disney world (and more) every year for the rest of my life. So if I go 10 more times, instead of “costing $50,000 (10 x $5,000/trip [[2 adults, 3 kids, on-site moderate, 6 days]])” - it only still “cost me” $12,000 - because all the other income was free money generated by my portfolio.

From the math, you’ll realize that $12,000 investment is actually paying me $800-1000/mo - which is $9,600-$12,000 in total income. That is enough to fund all the vacations I take every year. So over the next 20 years, I’m saving almost $240,000 in vacation costs. If this continues to work.

THE UNKNOWN

The Yieldmax funds are relatively new and it’s unknown how they will perform in a down market. There is a subtantial risk of loss of money for sure with these new fund types. That’s why they don’t make up more than about 20% of my portfolio where my play money is, and less than 1% in my retirement account.

As such, I would not recommend anyone go out and do this particular thing unless they are ok with losing their $12,000.

UPDATE #3

As noted in last months entry, I have changed from “Disney vacation fund” to just “Vacation fund”. I began selling options and invested in 1 other YieldMax ETF (YMAX) that will also fund “General vacations”. But for this experiment, I’m only going to use income from the 3 funds that I originally began this experiment with. I did add a few more shares to get to an even 200 across the board. That was simply because having odd numbers of shares was bothering me. This could certainly still work as originally set up 3 months ago.

Balance History with current values:

JUNE ($14,297)

AMDY - $3,463, 200 SHARES (+ $147)

CONY - $4,788, 200 SHARES (+ $1429) ** added 45 shares to get to an even 200

NVDY - $6,046, 200 SHARES (+ $962)

MAY ($11,758)

AMDY - $3,316, 200 SHARES (+$528) ** added 50 shares to get to an even 200

CONY - $3,359, 155 SHARES (-$526)

NVDY - $5,084, 200 SHARES (-$178)

APRIL ($11,935)

AMDY - $2,788, 150 SHARES

CONY - $3,885, 155 SHARES

NVDY - $5,262, 200 SHARES

JUNE 2024 - PAYOUT #3 ($1,032.40)

Total Disney World account is now $2,849.71 - with 4 months to go.

Averaging the 3 months of payments I’ve received since I began in April to calculate possible future distributions for the next 4 months, we’ll be right at $6,500 which should be more than enough to pay for everything needed for the 4 days well actually be on-site at Disney World.

Update #2 - How I get “free” Disney World Vacations.

Why pay for Disney World, or any vacation, if you don’t have to? In this series, I’ll lay out the exact steps I use that have allowed me to never have to pay for a family vacation out of my own pocket ever again. Anyone with a job and some budgeting can make this happen.

BACKGROUND

If this is your first time here, what I did was take about $12,000 and invest it into 3 YieldMax ETFs that pay high dividends every month. I collect that income and move it to my vacation savings account every month. The dividend varies every month, as does the total balance of the amount invested due to stock market price movement.

Balance History:

MAY ($11,758)

AMDY - $3,316, 200 SHARES (+$528)

CONY - $3,359, 155 SHARES (-$526)

NVDY - $5,084, 200 SHARES (-$178)

APRIL ($11,935)

AMDY - $2,788, 150 SHARES

CONY - $3,885, 155 SHARES

NVDY - $5,262, 200 SHARES

MAY 2024 - PAYOUT #2 ($695.57)

We had a few weeks of downturns in the markets which affected the distributions, but it was still almost $700 for the month. I also added 50 shares of AMDY and plan to get to 200 shares on CONY as well, so I have 200 shares of each fund.

Total Disney World account is now $1,817.31 - with 5 months to go.

CHANGES FOR NEXT MONTH

I’m going to change the savings account to just a “vacation account” and use additional monies from other sources to fund it more.

I recently started trading options, which I’ve found is literally like printing free money. I’m going to start adding option income to the vacation fund.

I bought another YieldMax ETF - MSTY and will be adding that income to the vacation fund also.

Note, I’ll still be tracking the “DISNEY VACATION FUND” as the main 3 YieldMax funds here, because those are specifically for Disney.

MSTY and Option income will be for other vacations.

How I get “free” Disney World Vacations.

Why pay for Disney World, or any vacation, if you don’t have to? In this series, I’ll lay out the exact steps I use that have allowed me to never have to pay for a family vacation out of my own pocket ever again. Anyone with a job and some budgeting can make this happen.

A simple 4 step process to ensuring I never pay out of pocket for a vacation again.

I know for a lot of folks, including us, our Disney trips took place on a 2-3 year cycle. That allowed us enough time to save money and figure out the game plan for the trip. In 2020/2021 I stumbled across an idea that has become the perfect way to never have to pay for a vacation again. Intrigued? Read on!

Walt Disney World - Magic Kingdome, Castle

IS THIS LEGIT?

Hold on, this is not going to be a post about using Timeshares or anything of that nature.

This is a legitimate method I am using IN THE REAL WORLD to pay for our Oct 2024 Disney World vacation.

Moving forward, I intend to use it for ALL my family vacations.

NOTHING IN THIS POST IS TO BE CONSTRUED AS FINANCIAL, TAX, OR LEGAL ADVICE.

I’M MERELY SHARING MY PERSONAL STRAGETY FOR MY FINANCES AS A FRAME OF REFERENCE.

INVESTING INVOLVES HIGH RISK AND POTENTIAL LOSS OF MONEY.

I AM NOT A FINANCIAL ADVISOR.

Let’s cut to the chase, obviously everything has a cost and nothing is truly free. But this is something I wanted to try, and some 3 years into this overall experiment it is working.

Walt Disney World - Lion King Show

Step 1 - PUT IN THE WORK

For those who don’t know my back story - in 2020/2021 during the Covid Pandemic, some friends and I started talking about trying to use investment income to supplement our day job income. But, I didn’t have any spare cash and needed money to start investing. Enter -The Side Hustle. Plus, I didn’t want to use my day job money that I used to pay my bills. I wanted money that didn’t matter if I lost it all in the market.

My girlfriend was already doing food delivery as a side hustle. So that gave me a starting point. I started working a variety of side gigs in addition to my 9-5 since we all had a lot more free time because there was no commuting to work and a lot of stuff was shut down. Here’s the things I did from Fall 2020 until the summer of 2023:

Food Delivery (Door Dash/Uber Eats)

Online Survey Taking

Affiliate Marketing through Amazon and Collective Voice

On top of that I also began to add the following in 2023:

Credit Card reward cash (mine pays 3%-5% cash back on most everything.)

Cash back from the “Upside” App

Walt Disney World - Water fountains, Epcot

Step 2 - START INVESTING

I took all that cash on the side and started buying high yield dividend stocks and ETFs with it. This nice thing about Food Delivery was, that paid out at the first of every week. So every Monday and Tuesday I was able to go on a buying spree. Over those 3 years or so, I experimented with A LOT of stocks and ETFs before settling on my current portfolio. As you can see below, the three funds highlighted in green are what I’m using to pay for all my vacations. It’s a small percentage of my overall portfolio. Other funds in there can be used to pay for other things like:

Eating out

House cleaning services

Car wash subscription

Netflix/YouTube TV etc.

Gym membership

As a result, none of those expenses actually take money out of my checking account and can be funded by investments!

There are a lot of YouTube videos on “high yield dividend” investing, and that’s where I got my start on this topic. Because before 2021, I didn’t know anything about it. Everything online, I take with a grain of salt. But now 3 years into it, I’m becoming a believer in this method of investing for monthly cash flow and passive income.

There are some tax implications, but I have adjusted my W4 to have more taxes taken out every paycheck to offset taxes from the income generated from my dividends and distributions.

What I decided to do for the vacation portfolio is take a very aggressive high risk approach with 3 YieldMax ETFs. Current balances are:

AMDY - $2,788, 150 SHARES

CONY - $3,885, 155 SHARES

NVDY - $5,262, 200 SHARES

Walt Disney World - Epcot, Space Mountain

SO HOW DOES THIS HELP ME?

You may be wondering what this does for me.

It all depends if you truly understand the philosophy of buying assets and letting those pay for your lifestyle. I hate it that it took me until my mid 40’s to truly get this concept. Since I was 23, I had only been focused on saving for retirement and piling up cash in my 401K and Roth IRA for growth (which is a good plan for sure) But….. Having additional money set aside in a taxable account that pays distributions out monthly will allow me to buy whatever I want, and yet, still have a huge bucket of cash that works for me 24/7/365 without me having to do anything else. It’s like having a big emergency fund that generates you free money every month.

Those 3 years of hard work have brought me some financial freedom. 3 years of sacrifice can change your life.

The main idea back during COVID was, “IF I lose my job, how will I pay my bills?”

I’ve found using this investing method works for me to never have to worry about where money will come from ever again.

Can you imagine if someone starts this at age 22, just out of college with no real financial obligations… At 32 - potentially financially free to do whatever you want whenever you want. That’s the American Dream right there!

(But I’d also say never stop investing in your 401K for the match and also your Roth IRA for tax free money later when you’re 60 something.)

Walt Disney World - Coronado Springs Resort

Step 3 - ENJOY THE REWARDS

APRIL 2024 - Payout #1 ($1,121.74)

As noted above, this is what I put my money in for the vacation fund.

AMDY - $2,788, 150 SHARES

CONY - $3,885, 155 SHARES

NVDY - $5,262, 200 SHARES

So far, that $11,935 invested should generate about $12,000/yr income on average for me based on current payout rates.

For April 2024, I received $1,121.74.

Remember, that $11,935 just sits there - producing about $1,000 every month!

It’s like a cash flow miracle.

While the future of these funds is unknown, if this level of payouts can be kept up along with the stock price holding steady more or less, I'll never have to worry about paying for a vacation out of my pocket ever again!

Disney World - Illuminations Fireworks Show at Epcot.

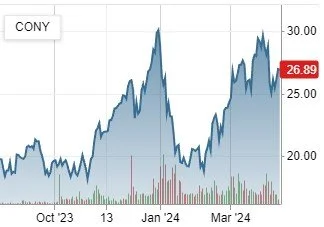

Step 4 - MONITOR

The overall “look'“ or trend of the charts for the 3 funds I’ve chosen for this vacation portfolio are either “FLAT” or “Slightly upward” which is what I want to see. That means my original principal investment is staying the same, while massive distributions are still being paid out every month. As long as that continues, this strategy will work. Should the chart start showing constant declines, then I’ll look for a different ETF. Since these YieldMax ETFs are very new, no one knows how they’ll perform in a variety of market conditions, but so far, these 3 have done pretty well.

This past week we had a huge drop in the market. That is not really concerning as long as over the next 30-60 days I see the share price of these funds going back up and distributions remain somewhat healthy. The income generated by these funds is really unprecedented in market history.

CONCLUSION

I hope you’ve enjoyed the inside info on how I fund my life and pay for things. It really has become a fundamental mind shift over traditional thinking and what we’re taught in school on money matters.

Traditional

Work —> Pay Bills

Mine

Work —> Buy Assets —> Pay Bills

If you’re intrigued, here’s what you need to do to get started:

I’d recommend getting with your tax advisor/cpa to see what kind of an impact this would have on your taxes before starting out.

Hop on YouTube and start watching videos on “"high yield dividend investing”. There’s a lot of content out there and that may give you some ideas to get started.

Find a side-hustle.

Start investing.

You may be asking, what about your photography income? Why isn’t it listed in the side-hustle category? - In the past I have used it to pay for vacations, as nearly every vacation I end up taking photos to sell or trying new techniques or testing gear out. So all those vacations become business trips and write offs. That may still be the case in some situations, but now I can pour more business money into marketing, buying gear, and education.

One thing to note, I do believe in growth for retirement and definitely keep things simple in my 401K and Roth IRA. Using a basic 3 fund portfolio (VOO, QQQM, SCHD and any variant like that… VTI, QQQ, DGRO, or FXAIX, FDVV, VGT) where you have the S&P 500 index, Nasdaq Index, and a quality dividend ETF will definitely be a winner over the long run too. With current interest rates at 5%, having some cash mixed in there in a money market fund isn’t a bad idea either. But once again, everyone’s life situation and risk tolerance is different. Talk to some professional folks about it before you do anything. Make sure you’re comfortable with investing for sure!

Have a blessed life!

~ Kyle